Drugs Are No Longer The Only King Of Pharma

By Kennet Hammerby and Mikkel Brok Kristensen

Pharmaceutical companies should begin to take a closer look at how they create the most value for their multiple stakeholders. In the emerging world of value-based health care, the answer will increasingly go beyond a new drug.

An evolution in health care

Imagine a future in which your health insurance company tells you to monitor how much you walk every day. Sounds crazy? Maybe, but it is already happening. Blue Care Network of Michigan, a U.S. health care provider, gave their obese customers an option: pay up to 20 percent more in health insurance premiums or walk 5,000 steps a day. After one year, 97 percent of the 7,000 customers who had enrolled in the program were meeting the daily required number of steps, which were counted using a pedometer and tracked online. A win-win situation all around: improved health outcomes and less cost for both Blue Care Network and their customers alike.

This is just one example of the shift in health care delivery that is affecting the pharmaceutical industry. From its inception the pharmaceutical industry has been driven by investments in R&D in the pursuit of new and improved drugs. The most-admired pharmaceuticals have used this model when launching blockbuster drugs while simultaneously nourishing promising pipelines with new compounds to develop and commercialize.

But things are changing. Overstretched public finances, above-GDP growth in health care expenditures, and aging populations have all served as drivers behind a rethinking of how health care is delivered. Given these challenges, we now see value based health care gaining more and more momentum throughout diverse health care systems. Though long talked about as the future, it appears that value-based care is finally beginning to replace the old fee-for-service model with a new system where providers get paid for delivering the best and most cost-effective care. The marriage between fitness bands and insurance premiums serves as one example how payers and providers are seeking completely new opportunities to fulfill this ambition — offering a taste of what will come as established consumer-tech players move into the health care space.

As Toby Cosgrove, CEO and President of the Cleveland Clinic puts it:

“No longer will health care be about how many patients you can see, how many tests and procedures you can order, or how much you can charge for these things. Instead, it will be about costs and patient outcomes: quicker recoveries, fewer readmissions, lower infection rates, and fewer medical errors, to name a few. In other words, it will be about value. And that is good.”

A less self-evident place for pharmaceuticals

The shift to value-based health care will not happen overnight. The current fee-for-service model is entwined in the structures, systems, and praxis that keep health care systems operating from day to day. Nonetheless, a profound shift is occurring, and it is our firm belief that the near-complete reliance on pharmaceutical and surgical interventions to achieve results will be challenged. The pharmaceutical industry, and innovative pharma especially, is therefore right in questioning whether a model built for success in a drug-focused era is enough to succeed in a more value- and outcome-focused era.

Pharmaceutical companies will be impacted in multiple ways by the change, but as we see it three implications are particularly fundamental:

1. The relative value of drugs will decline

In a world increasingly focused on cost-effectiveness, the relative value of drugs will decrease vis-à-vis other treatment options such as behavioral modification, counseling, and active surveillance (rather than active interventions). This is partly driven by a growing belief in the importance of behavioral factors in determining outcomes, as well as an emerging quantitative understanding of the effects of such methods. But it is also driven by a realization that sometimes it might be just as good, or maybe even better, to simply monitor low-risk conditions rather than actively treat them[1]. The result will be a diversified treatment landscape where the growth of non-pharmaceutical interventions creates downward price and use pressures on pharma.

2. A raised bar for innovation

Another concrete consequence is a heightened questioning of the value created by some new drugs. Payers, providers and prescribers alike are increasingly skeptical towards the value created by new offerings in already-saturated pharmaceutical markets. Demands for novelty no longer stop at “Is it better or not?” Now, increasingly, the question is, “is this product significantly better? Does it warrant the price increase?” The result is a growing number of new drugs where companies will have to settle for a price “as is” or focus on the few markets and/or segments that are willing to pay a premium. Only occasionally, when something is deemed a real radically innovation, will it be able to command a price premium.

3. Sales will be required to deliver much more additional value

Thirdly, the pharmaceutical sales model, which has become such an important part of the pharmaceutical business model, will undergo radical changes. As gifts and freebies have been left behind, access to doctors’ offices today depends on the pulling power of free samples. But as providers view little additional value in having a sales representative stop by, clinic doors are increasingly closed to pharma. Faced with these challenges, sales forces will have to redefine the value they create for providers by building a clearer, more supportive (rather than exploitive) sales interface that works together with providers in delivering on patient needs and improved health outcomes.

New capabilities are needed

The fact that changes in health care will not happen overnight provides an opportunity for early movers. Those with foresight can stay ahead of the game by beginning to explore and define the road to success in an era where health care will increasingly focus on delivering the best possible outcomes at the lowest possible cost.

Pharmaceutical companies will have to ask themselves what changes to their current modus operandi they will have to make: Should we move away from the existing sequential way of managing the business (investing in R&D, ensuring market access and commercial success)? Should we explore alternative models? Should we explore partnerships in different ways than before?

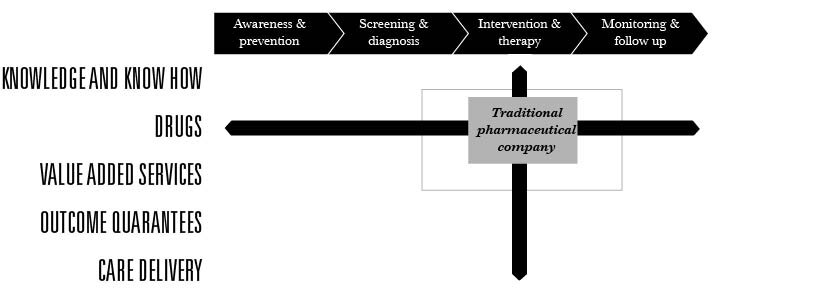

Incorporating a value-based mindset throughout the health care value chain can present new challenges to the traditional pharmaceutical company. As figure 1 shows, these challenges will inevitably be centered on exactly how far a drug manufacturer can broaden its focus going upstream (prevention and diagnosis) or downstream (monitoring and follow-up) – as well as how willing and able it is to change its core role as drug supplier towards taking a more active role in health care management.

Model Pharma

The move towards value-based health care is also leading to industry convergence attracting new players from the consumer and tech industries as well as fostering new types of partnerships and M&A activities across industry borders. This makes it even more important to carefully examine one’s strategy.

Some major players are already taking a lead here. In January 2014 Merck announced their investment in an FDA-cleared diabetes management business. Established in 2006, WellDoc is now ready to push ahead with the commercialization of BlueStar, its FDA-approved mobile Type-2 diabetes management product that requires a prescription.

WellDoc cofounder and CEO Ryan Sysko tells MobiHealthNews:

“When you look at how active Merck GHI has been in investing in digital health, they have acquired a lot of knowledge about technology —consumer technology, digital health technology, you name it.”

At the same time, consumer and tech companies themselves are starting to invest in areas that they never would have considered a decade ago. For example, Jawbone, a San Francisco-based consumer-tech company best known for its Bluetooth headsets and iPod speakers, has acquired several personal health companies over the past year, including mobile health startup Massive Health, body-monitor developers BodyMedia, and nutrition-app maker Nutrivise. With these acquisitions, Jawbone are poised to become the market leader in digital personal health.

Adaption starts at understanding

Adapting to a more value-based paradigm will pose a substantial challenge for most pharmaceutical companies. Being successful today with an R&D and commercial strategy built upon getting blockbusters to market does not mean that you will be successful in tomorrow’s value-dominated market. As figure 3 illustrates, the demands on the business system will be quite different. Companies will therefore benefit from examining how much focus to put on innovation driven by drug discovery versus how much innovation should be pursued versus business model innovation:

Changing the focus towards a more holistic health care management approach can seem like an impossible task for any company, as any changes in strategic direction will inevitably have deep consequences for the company DNA. But it is far from impossible.

When adapting to such a radically shifting marketplace, most successful companies do not change their strategy overnight, but focus on three guiding principles that enable them to manage the risks in refocusing their businesses on new market realities:

Gain profound stakeholder understanding

Developing new interventions and services within a specific disease area requires deep understanding of the relevant stakeholder ecology and stakeholders’ needs, motivations, and barriers. However, once this is obtained companies can then develop stakeholder specific value propositions and understand how to support stakeholders in their quest for better patient outcomes at lower costs.

Getting depth of insight and breadth of applicability is key to gaining such stakeholder understanding. Depth can be gained through immersion in the everyday lives of stakeholders, be they HCPs or end users. It can also be gained by incorporating an ecology approach that recognizes that stakeholders seldom act in isolation but are instead influenced by their relationships to other influencers (read more about taking an ecology approach here[GE2] ). Breadth, on the other hand, can be obtained through recognizing that, although commonalities exist, stakeholder profiles and behavior are deeply conditioned by cultural, social, and historical factors which vary significantly across (and sometimes within) markets.

Key question: What is the gap between what our stakeholders need and what we currently deliver?

Key outcomes: Value propositions that are built on real-world needs and that extend beyond the traditional medical core, as well helping multiple stakeholders reach their goals.

2. Identify the most relevant opportunities

It is vital to take a pragmatic view to what and how much the company sets out to engage in. This requires a systematic and analytical approach to identify and map potential opportunities. These opportunities will then need to be further refined through analysis to understand their respective benefits (e.g. improvements in patient outcomes, branding/PR and financials) as well as their risks (e.g. feasibility, areas where it can go wrong).

Key question: What are the emerging opportunities and which are we best positioned to deliver on?

Key outcomes: Clearly identified opportunity areas to focus innovation efforts on.

3. Mobilize internally and externally

As most pharmaceutical companies are strongest in research and clinical development, it must be anticipated that not all required competences are present to lead initiatives that will make the company a more holistic health care provider. It is therefore essential to assess the insights and capabilities that exist within the company already, and those that need to be acquired externally.

Key questions: Where do we need to strengthen our organization in order to deliver on our value propositions and identified opportunity areas?

Key outcomes: An organization that has the capabilities to deliver on promises in value-based health care.

Adaption starts at understanding

The emergence of value-based health care will continue to create an immediate future of instability where both payers and providers experiment with new models and practices for delivering better outcomes at a lower price. While this is a time of disruption and confusion, it is also a time that will open up significant opportunities for the pharma industry — if players place the right bets. As we have outlined in the steps above, placing these bets (which requires identifying opportunities and managing risk) always begins with one critical endeavor: Deep customer understanding. It is only through the ability to align your business with your customers’ needs that you will be able to avoid fumbling around in the dark and deliver products that connect with the evolving requirements of Value-Based Care.

[Banner image by Hal Gatewood, via Unsplash]

[1] For example, new clinical guidelines in the UK stipulate that men with low-risk prostate cancer should be offered a choice between active surveillance or surgery/radiotherapy. The guidelines include a protocol for active surveillance which involves replacing treatment with regular check-ups and thus offers sufferers the chance to avoid the side effects and complications of treatment that might not be necessary during their lifetime (NICE 2014).